Pensions Are Bad, full stop. There are many reasons for this:

-

Pensions are unfair

-

Pensions are risky

-

Pensions are complicated

-

Pensions are dishonest

Pensions Are Unfair

Specifically, the pay-as-you go pensions. Which essentially all government pensions are. In every meaningful way, they’re a pyramid (not Ponzi, there is a difference) scheme. Each cohort of pension recipients are ultimately getting money from their own children. The one sentence-proof is as follows: there is no method, in a PAYGO pension system, Social Security the most well-known of them, of guaranteeing that the pension fund remains solvent.

Singapore guarantees that their Central Provident Fund remains solvent. They do this by eliminating all longevity risk, through selling the contents of the Central Provident Fund at retirement age into an annuity. This means that the CPF itself has 0 chance of ending up with too little money. When you’re 64, the CPF has all your money. Once you’re 65 (or older), someone other than the pension fund has promised to pay you for the rest of your life. At no point has the pension fund made a promise based on money they don’t actually have yet, and they can guarantee that the CPF account will have the money you were promised!

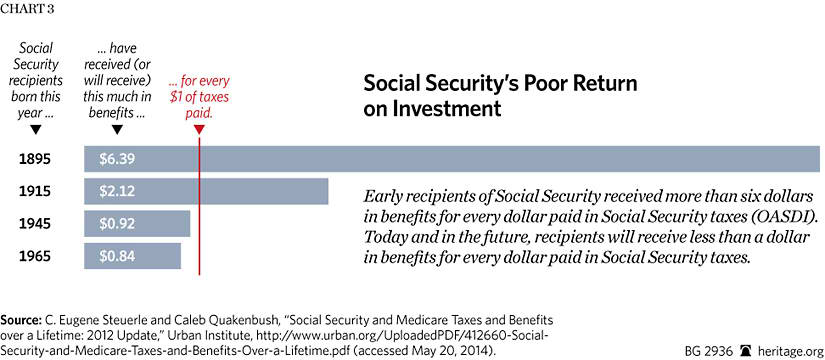

The unfairness of PAYGO pension systems simply means that some people will be getting a lot of money from people who won’t be getting a lot of money themselves. So someone putting money into Social Security when it was new will be getting a huge amount more than what they put in, inevitably coming from someone who’ll get out a lot less than what they themselves put in. It might not be you, in particular; but it’s still incredibly unfair to effectively force a huge amount of debt onto future generations, because you didn’t have the heart to let people who didn’t save up a lot of money not have much money saved up.

Pensions Are Risky

Although I had my complaints about pensions being a raw deal for those paying into them, far more obvious and terrifying is the fear of pensions proving a disaster from those trusting them. Horror stories of pension plans getting cut during mergers and acquisitions, or companies struggling and sacrificing your pension before their debt, are widely-told in the private sector.

For many people, pensions account for a huge fraction of their life savings. Beyond those rich enough to start putting their money into the stock market, someone’s own home is generally their largest source of wealth, with their pension being in second place. It’s not uncommon for pensions, with their returns, to end up with values in the hundreds of thousands.

And a big percentage that money could prove illusory if whoever pays for your pension makes a mistake. Your pension can go up in flames in a moment, as a consequence of causes far outside your control. It’s an incredible amount of risk that often gets taken, essentially without your consent. Sears retirees were quite surprised to find that their pensions cut by 30%. In Detroit, bus drivers and others had to pay back tens of thousands of dollars from their pensions, after stupid decisions on the part of the city government led to the city’s bankruptcy.

Pensions Are Complicated

I’ll say this twice: pensions are complicated. They add a surprisingly large amount of work when when trying to read the accounting of companies, or when calculating the financial situation of public agencies. Discount rates and expected returns and shortfalls and mortality assumptions and on and on and on.

Pension funds require a vast amount of effort from a huge range of employees to administer, because they are among the most complicated parts of any business' balance sheet. I think that a world without pensions would be little different beyond the vast reduction in confusion and esoteric accounting debates. People would still save for retirement, receive essential living funds from the government, and build wealth over decades. And beyond that, there are far fewer attempts at scheming to lie about the cost of government agencies, by using pensions.

Pensions Are Dishonest

Many companies don’t put enough into their pensions. This is due to accounting rules I don’t fully understand. But they’ll use all the latitude they have to puff up the pension as much as they can, while secretly putting as little into as possible.

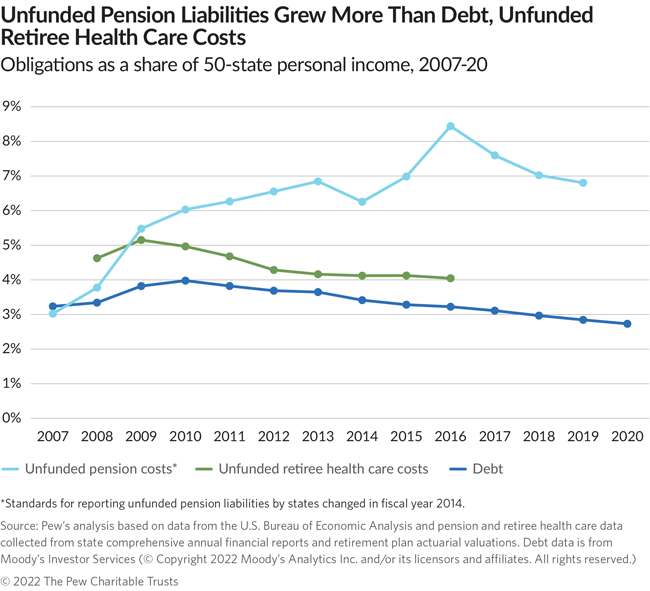

Pensions are mostly, however, a brilliant method of letting politicians do something unfair. They can stealthily rack up debts that their successors will be on the hook for.

The awful truth is that a pension is a liability. It, just like taking out a loan to buy McDonalds stock (or McDonalds restaurants), is a way of having more money now, at the cost of giving that money back later, with interest. Pension is leverage, making your company (and you) more exposed to fluctuations in the markets.

A government agency taking loans to pay for hiring teachers and buying schoolbooks is obviously scandalous. But in fact, the amount of debt took out by governments for teachers and other government services, is now easily in the trillions dollars. That debt being pension money owed to those they employ, a clever method of conceal how much they’ve taken out in loans.

Basic Income is Better

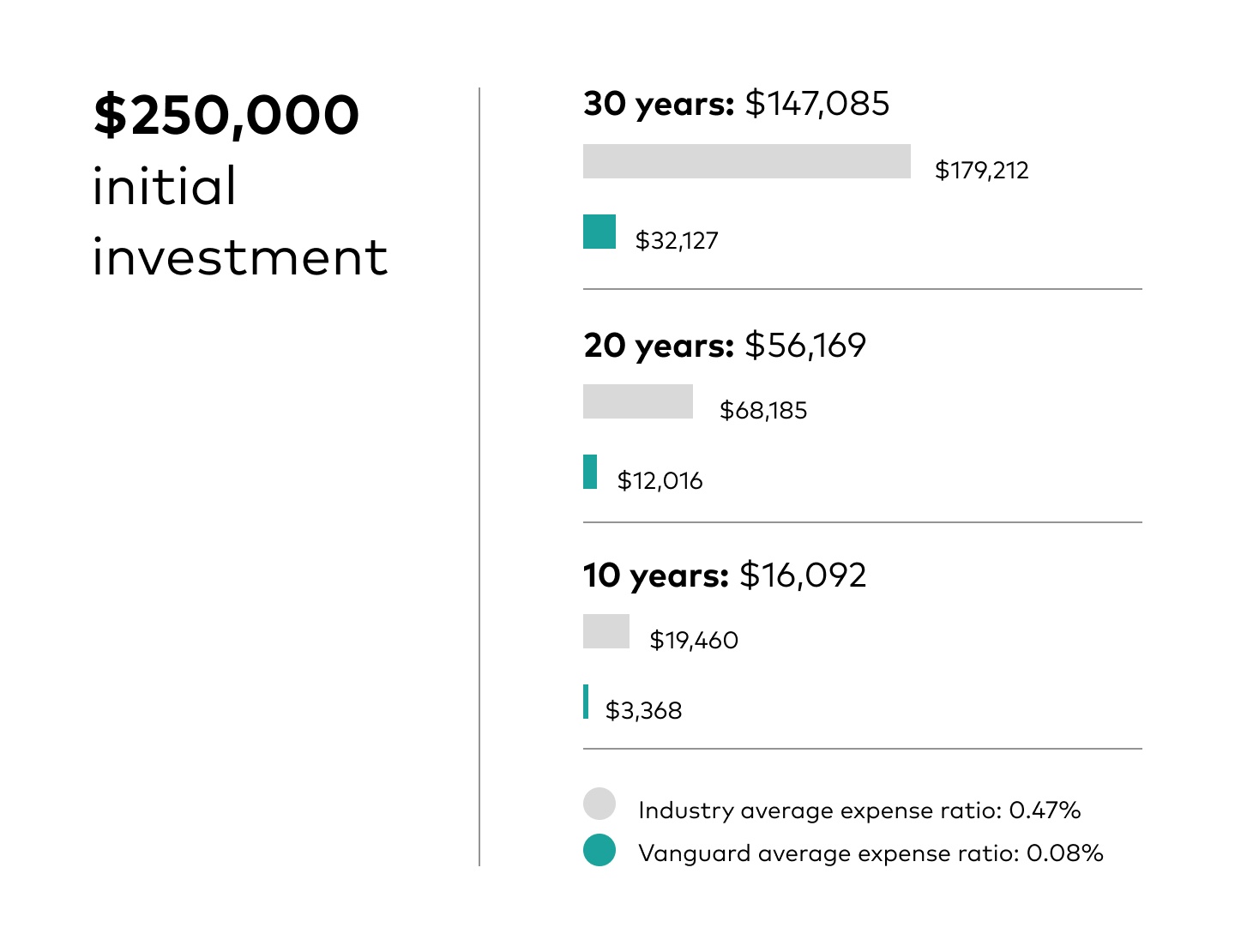

A basic income, together with a system of disability (and probably also health) insurance, would be better than than today’s complicated pension systems. You wouldn’t be forced to defer consumption until retirement age. You would be able to earn more in investment returns than the Social Security trust fund. Compound interest means that even small differences in returns get huge over time. So it means a better retirement for you. Vanguard made a helpful diagram showing how much less money you’d have if you made just 0.4% less on an investment usually earning 6%.

The basic income would end poverty, not just among the elderly, but for everyone. It’d be more fair; it doesn’t have liabilities that the next generation must cover. All the money gets redistributed immediately.

It’s hard to give a number for how high the basic income should be. We do know, however, that disability insurance would be amazingly affordable. The cost of long-term disability insurance, to replace 50% of income, is perhaps 2% of your salary on the low end. A government (re)insurance system would lower costs through economies of scale and less risk-aversion. So it’d help push that number down, if only slightly.

In the end, it’s not a complicated situation. A pay-as-you-go, or defined benefit pension, where you’re promised a certain percentage of your income for the rest of your life, is a debt that’s paid off with money from new people paying in. A basic income would get its money, not from a hypothetical future, but from money being moving from one person to another, today. That makes it very much better than the pension systems we’re using today. This simpler approach is fantastic for 4 reasons:

-

It’s fair

-

It’s safe

-

It’s simple

-

It’s honest